Rule Of 80 Texas Ers

This Rule of Eighty estimator is provided for illustration only based on the financial information you entered and is not an official means of determining the timing or amount of benefits that you may be. Rule of 80 to be eligible for the States insurance program.

The Time To Fix Texas S Public Pensions Is Now Underfunded Retirement Plans For Public Workers Jeopardize Prosperity City Journal

And 2 persons who served in military duty during World War I to receive prior service credit without making deposits.

Rule of 80 texas ers. The individual meets the Rule of 80 total of age plus years of state service credit equals or exceeds 80 with at least. Effective September 1 1997 the Rule of 80 allows a benefits eligible employee to be eligible for Employees Retirement System ERS health insurance funded by the State of Texas. LECOS employees contribute an additional 05 for a total of their gross monthly salary deducted on a pre-tax basis and placed into the employees personal state retirement account.

Minimum of five years of service at age 65 or if they met the rule of 80. There are no changes to the retirement eligibility for members of the elected class. Age 65 or meet the Rule of 80 years of service credit plus age equals or exceeds the number 80 The last place of state employment prior to retirement is UT and Retire under Teacher Retirement System of Texas TRS Employee Retirement System ERS or the Optional.

If you have service credit in both ERS and the Teacher Retirement System of Texas TRS you may combine ERS and TRS service credit at retirement. The individual has at least ten 10 years of service with the System. Retirement estimates are not binding on TRS and are subject to audit adjustment and correction.

Percentage of your best 3 years salary. Meet the Rule of 80 or 2. Employees certified by the Agency as having regular contact with inmatesreleasees defendants are eligible for LECOS supplemental retirement benefits through ERS.

Are at least age 65. There wouldnt be an age reduction for retiring before age 50 and he or she would be eligible for a PLSO. Benefits will be based on the highest 60.

Visit the Request for Estimate of Retirement Benefits page. The primary points of this retirement plan are. After the 18 months of COBRA has been exhausted and until the retiree reaches age 65 insurance may be continued with the individual paying the full cost of such insurance.

You must be at least age 60 with a minimum of five years of service credit. This adoption does not include any PUC or TCEQ rules addressing the use of. Service add up to the number 80.

If you meet the Rule of 80 you are eligible to retire before age 65 with a monthly retirement payment health insurance and optional benefits including dental and vision coverage regardless of which retirement group you are in. Year youre eligible to retire under the Rule of Eighty. Employees must still meet the Rule of 80 but must work until age 62 or have a 5 percent reduction in their annuity amount for each year they retire before age 62.

60 or above. A The individual meets the Rule of 80 total of age plus years of benefits eligible state service credit equals or exceeds 80 or the individual is at least age 55 with five 5 years of benefits. You may receive one month of service credit for each 160 hours or fraction of 160 hours of unused sick or vacation leave.

If you wish to receive a written estimate of your projected retirement benefits from TRS please either. Number of years to go before you become eligible under the Rule of Eighty. The following information applies to employees who were ERS members on August 31 2009.

Rule of 80. If a CPOCO members age plus years of service equal 80 he or she can retire under the Rule of 80. The lifetime annuity will be equal to the members accumulated account balance plus a 150 employer match at retirement.

If you are approved for disability retirement AND have a minimum of 10 years of participation with the Group Benefits Program through ERS then you are able to continue with health insurance benefits prior to meeting the Rule of 80. Your age years and months of service 80. Rule of 80 Estimator.

You will need to log in to MyTRS and then select this calculator. Brandon 49-year-old correctional officer at the Texas Department of. The procedural rules of the Texas Commission on Environmental Quality TCEQ are adopted by reference are those enacted in Title 30 Chapter 80 of the Texas Administrative Code.

Or Print complete and mail your request using the TRS 18 form pdf. You may retire under the rule of 80 if your years and months of service credit at least five years and your years and. Service Credit Age 80 or above Minimum of 5 years of service credit.

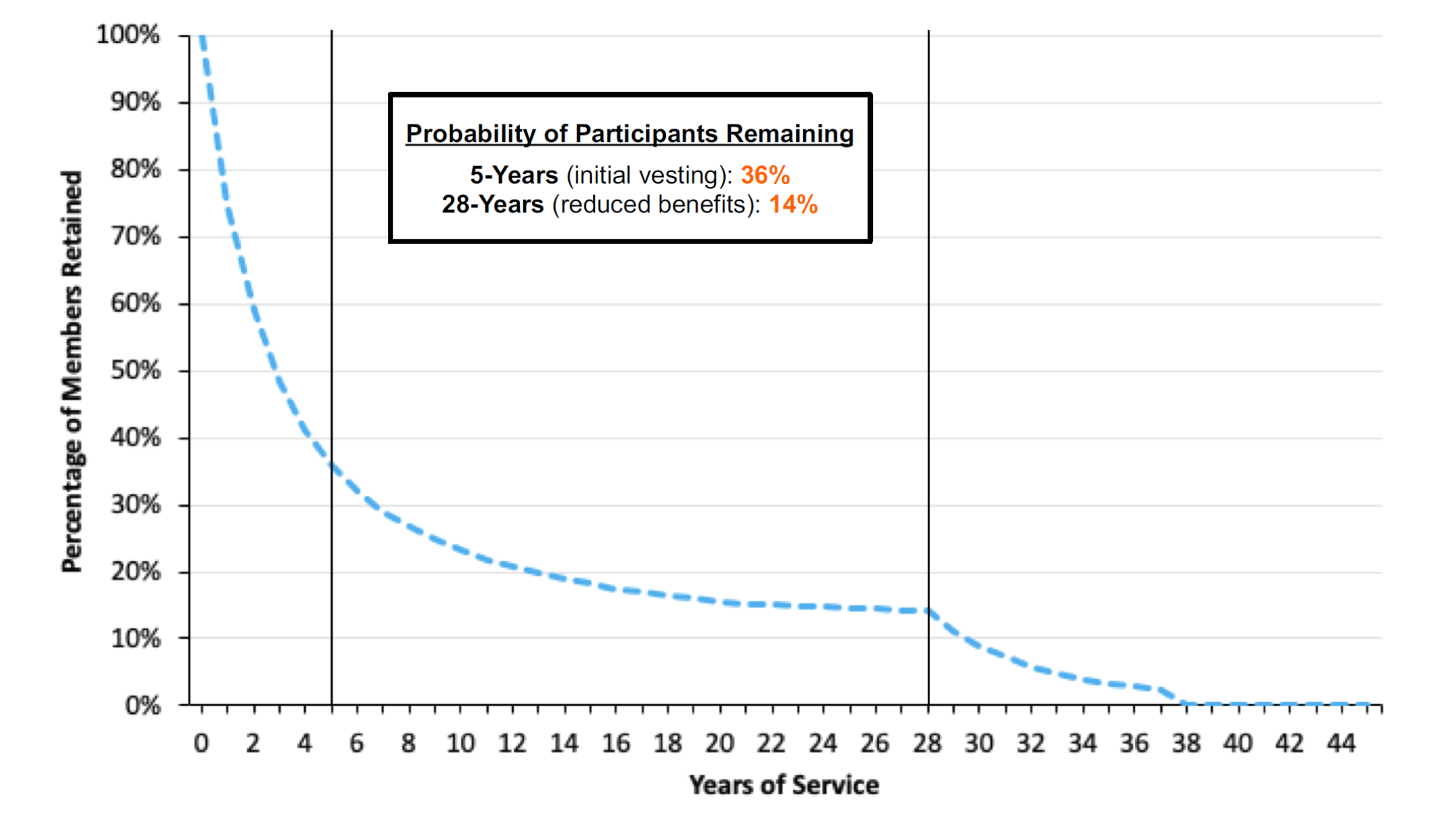

If worker retention is a goal of the ERS Texas system it is clearly not working as nearly 65 of employees leave within 5 years. The advantage of this is that it automatically imports current data from your TRS computer records. To be eligible to retire.

You will have a 60-day waiting period before your insurance benefits begin if you. After 20 to 30 years of service there is some retention effect but the same incentives serve to push out workers in a sharp drop off after 30. Do not retire directly from state employment or Retire under the age of 65 and do not meet the Rule of 80.

Your service credit must be established not withdrawn with ERS at the time of retirement and. Teachers in public schools for up to 80 days on a substitute basis or on a onethird time basis not to exceed six- semester hours. Different retirement eligibility rules.

Proof of good health evidence of insurability will not be required after your 60-day waiting period. And The individuals last state employment before retirement was with an institution of the System. Yes Yes Minimum of 10 years of service credit.

Pursuant to the notice of the proposed rule review that was published in the February 21 2020 issue of the Texas Register 45 TexReg 1244 the Employees Retirement System of Texas ERS reviewed 34 Texas Administrative Code TAC Chapter 85 Flexible Benefits pursuant to Texas Government Code 2001039 to determine whether the reason for. For those that retire with no insurance insurance is available through COBRA for 18 months. Rule of 80.

Veteran Benefits For Texas Veterans Guardian Va Claim Consulting

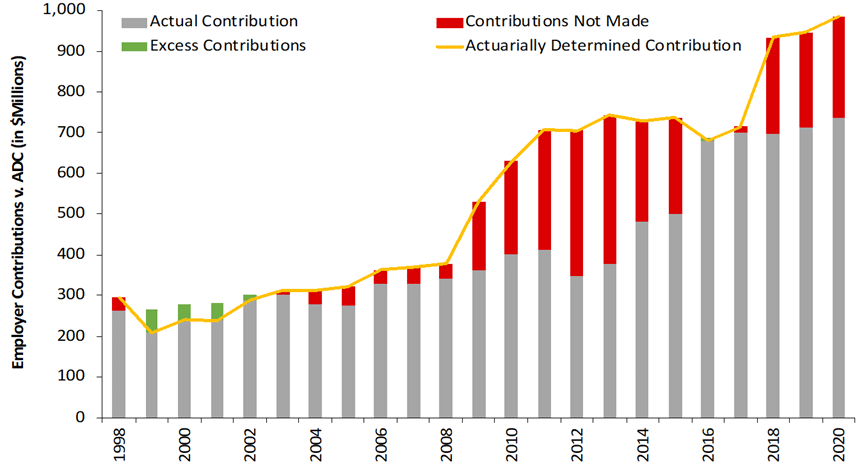

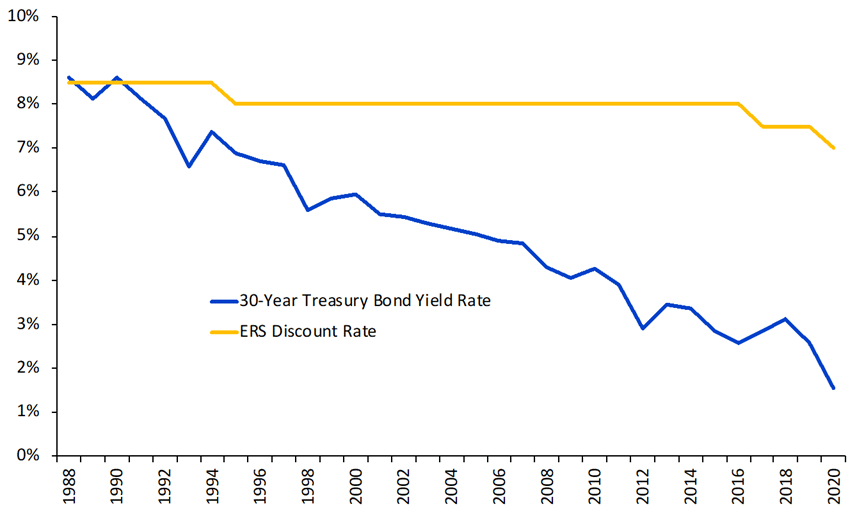

Texas Employees Retirement System Ers Solvency Analysis

Pension Spotlight Texas S P Global Ratings

Answers To Questions About The Upcoming Cash Balance Retirement Benefit For Employees Hired After Fy22 Ers

Texas Employees Retirement System Ers Solvency Analysis

Your State Of Texas Retirement Benefit And The Ers Retirement Trust Fund Ers

Chris Ardis Education Columnist Compare Trs Of Texas And Ers Of Texas It S Time To March

Texas Employees Retirement System Ers Solvency Analysis

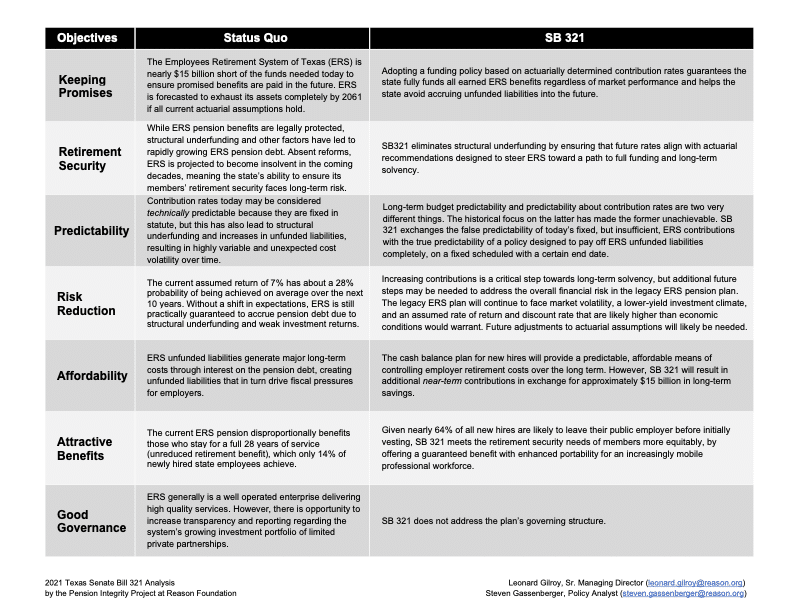

Landmark Texas Pension Reform Law Tackles Funding Issues Secures Employees Retirement Benefits Reason Foundation

Texas Military And Veterans Benefits The Official Army Benefits Website

Your State Of Texas Retirement Benefit And The Ers Retirement Trust Fund Ers

Your State Of Texas Retirement Benefit And The Ers Retirement Trust Fund Ers

Usda Ers Irrigation Water Use Irrigation Sprinkler Irrigation Water

Landmark Texas Pension Reform Law Tackles Funding Issues Secures Employees Retirement Benefits Reason Foundation

Texas Employees Retirement System Ers Solvency Analysis

Posting Komentar untuk "Rule Of 80 Texas Ers"