Dcad Property Tax Payment

Partial payments are accepted and will reduce any penalty and interest owed. You may pay your real property tax bill with a check or money order payable to the DC Treasurer Be sure to include your square suffix and lot or parcel and lot numbers on your check or money order.

1 results in a penalty of 6 percent plus 1 percent per month until July 1 when the penalty becomes 12 percent.

Dcad property tax payment. To obtain a copy of your appraisal notice please contact the Denton Central Appraisal District. Once you have read and understood the requirements please select Pay Online and you will be redirected to Certified Payments. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844.

Online Property Tax Estimator. All payments made before 5 pm EST are effective the same day they are authorized. Welcome to the Denton CAD website.

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. Paying Your Property Taxes. Ad Valorem Tax Rates for Dallas County.

You may pay all years due or make a partial payment of your taxes. Payments may not be scheduled for a later date. Payments by mail must be made by cashiers check personal check or money order to.

Disabled Person - 10000. Property Owners Have Certain Rights That May Reduce Their Property Tax Burden 2021 TAD is responsible for property tax appraisal and exemption administration for over seventy jurisdictions within Tarrant County. 940 349-3800 or Email.

Homestead Exemptions Reduce Your Taxes. When you receive an over-65 or disabled person exemption you also receive a tax ceiling for your total city and school taxes. Search MyTaxDCgov and go to Make a Real Property Payment Enter your square and lot or your address.

800 AM - 500 PM Monday - Friday Saturday Hearings. To pay your taxes online please click the property search button above search your property and click the green pay button. January 1 - April 30.

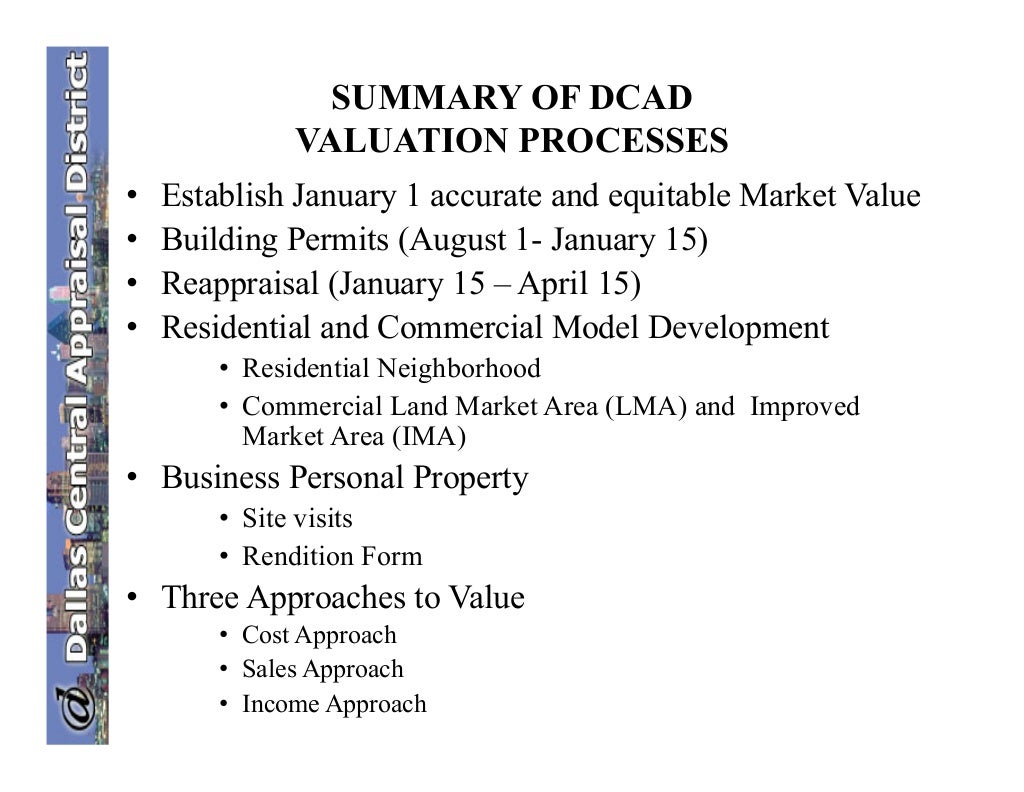

The appraisal district is responsible for appraising property in the district for ad valorem tax purposes of each taxing unit that imposes ad valorem taxes on property in the district. Pay Your Taxes - Ventura County. The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8a of the securities act of 1933 or until the registration statement shall become effective on.

Also include the top portion of your bill to help us process your payment on time. List of Tax Collecting Agencies. New Online Property Tax Estimator.

Each jurisdiction sets its tax rate to provide for police and fire protection public schools roads and streets district courts. The ceiling is set at the amount of taxes you pay in the year that you qualify for the over-65 or disabled person homeowner exemption. We jurisdiction cannot assist you in questions about.

Homestead Exemptions Reduce Your Taxes. Citizens over 65 - 25000. Dallam CAD Official Site Dalhart TX.

Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email. The Tax Office accepts property tax payments online by telephone by mail or in person. To use the MyTaxDCgov online payment system.

See below links. Taxes due to local taxing units or county tax assessor-collector if acting on their behalf. A 275 convenience fee of the amount paid will be charged with a minimum 1 fee.

Property Not Previously Exempt. Mail your payment in the envelope provided. Partial payments will be applied on a pro-rata basis to tax penalty interest and collection penalty if applicable.

List of Tax Collecting Agencies. Contact DCAD with any questions. 2021 Low Income Housing Rate.

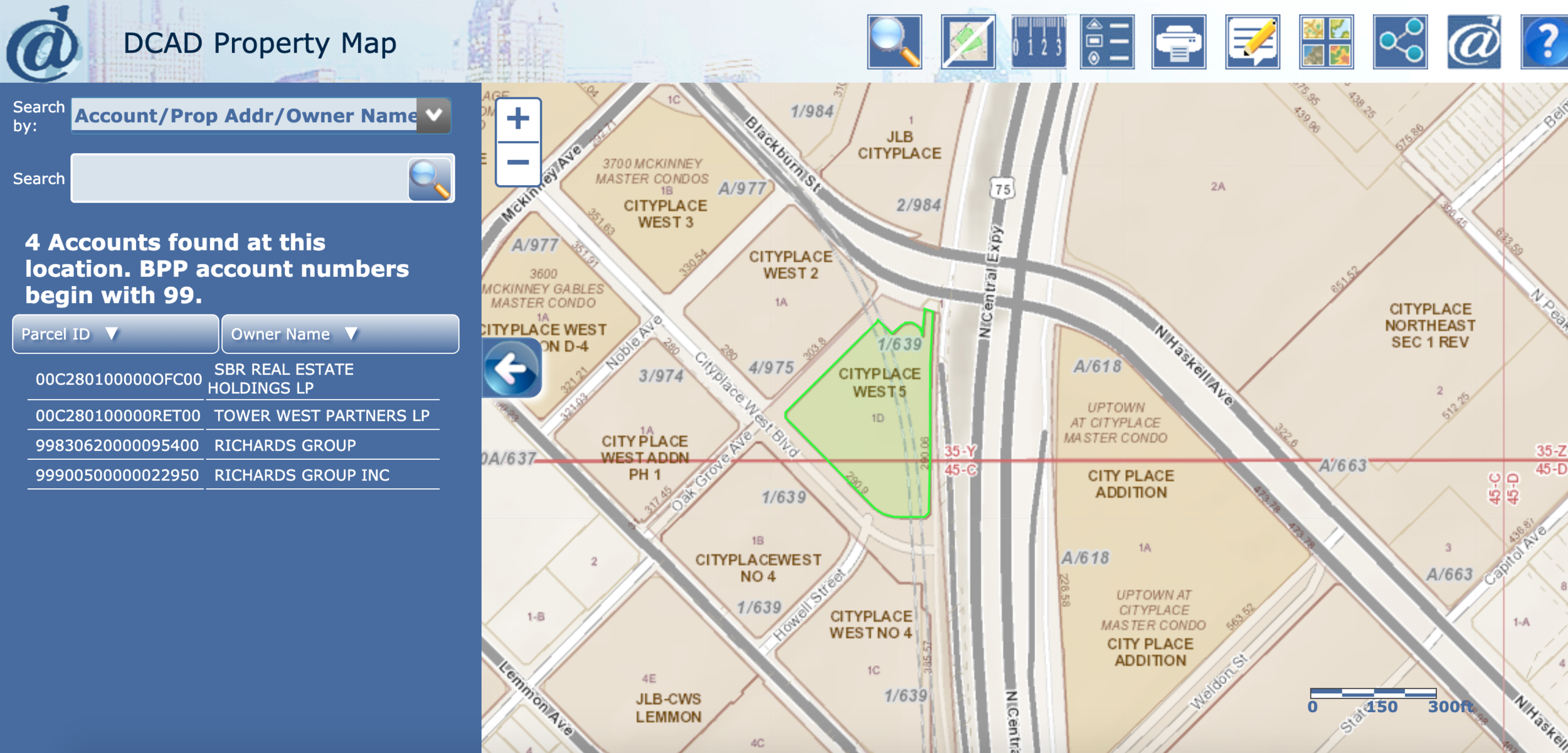

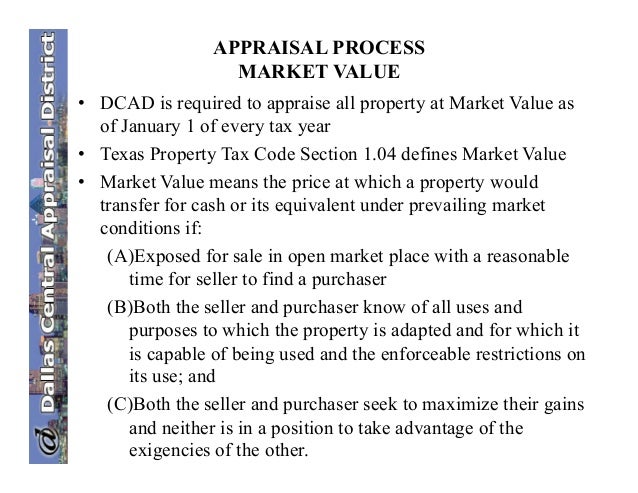

Dallas Central Appraisal District DCAD is responsible for appraising property for the purpose of ad valorem property tax assessment on behalf of the 61 local governing bodies in Dallas County. Denton CAD will be shutting down our software system on July 22nd 23rd and 26th to certify the appraisal roll. Property taxes are collected by the Dallas County Tax Office in one installment.

CADs are required to appraise property at its value on this date. Ames CTA Dallas County Tax AssessorCollector PO Box 139066 Dallas Texas 75313-9066. Persons paying property taxes may use multiple and any combination of credit cards or multiple e-checks to pay their taxes.

Failure to pay these taxes before Feb. Contact DCAD with any questions. Please call or email us on July 27th if you have questions about your account or if you are questioning your protest status.

Click on your property to retrieve. Unpaid balances will be subject to penalties and interest. Under the law penalties and interest continue to accrue during payment arrangements.

Real Property Tax Real Estate 206-263-2890. CAD completes appraisals and processes applications for exemptions. City of Garland commercial customers can pay taxes online for the following.

General Homestead - 25000. Ad Valorem Tax Rates for Dallas County. Property tax workshops holiday schedules and closings application deadlines and more.

Debit Card Fee 295 per transaction. Case or Cause Number. 15 and are due Jan.

Home - Denton CAD. The appraisal district is a political subdivision of the State of Texas. Bills are mailed about Oct.

FAQ - Paying Your Property Taxes Page 1 0118. When you pay you will get a reference number as proof of your payment. Harris County Appraisal District 13013 Northwest Freeway Houston Texas 77040-6305 Office Hours Hours.

Please understand that Dallas Central Appraisal District DCAD does not control the tax rate and the amount of tax levy as this is the responsibility of each taxing. A lien attaches to each taxable property to ensure property tax payment. Please contact our collection firm at 214-880-0076 to establish payment arrangements.

Dear Dcad It S Your Turn To Make Your Case D Magazine

What Is A Hud Listing Avoid Foreclosure Foreclosure Help Foreclosures

Dear Dcad It S Your Turn To Make Your Case D Magazine

Dallas Public Schools Dcad And Fair Market Value

The Richards Group Defaults On Tax Abatement Agreement Relinquishes Nearly 800 000 In Incentives Reform Dallas

Dallas Central Appraisal District Dcad Value Process

Property Tax Assessments Hit The Mail Today We Re Probably Not Paying Enough D Magazine

Fillable Online Dcad Dallas Central Appraisal District Business Personal Property Division P Dcad Fax Email Print Pdffiller

How To Argue Down The Value Of Your Home D Magazine

Property Tax Protest Filed In 10 Minutes Thanks To Propertytax Io

Posting Komentar untuk "Dcad Property Tax Payment"